Power Ranch TOUGH MONEY Workshop

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus eget semper sem. Quisque sed convallis quam.

Stop financing everyone else's future, start Banking on Your$elf!

Power Ranch TOUGH MONEY Workshop

Presented By: Joshua Smith & Monty Flack

When & Where

Date & Time

November 20th, 2025

Location

Ranch House - 4444 E Haven Crest Dr Gilbert, AZ

About this Event

2 Hours

Why Are So Many High-Income Earners Still Living Paycheck to Paycheck?

It’s not just a spending problem; it’s a strategy problem.

At Factum, we’ve identified two major barriers keeping Americans from building real wealth:

🔹 A lack of practical financial education

🔹 Storing money in the wrong environment

Join us for our upcoming workshop where we’ll break this cycle and show you how to:

✅ Take control of your savings

✅ Build true liquidity and long-term stability

✅ Design a more efficient wealth-building system

✅ Begin assembling your personal wealth team

This monthly series is designed to empower you with tools, clarity, and strategy, not sales pitches.

📅 Reserve your seat today and take the first step toward financial independence.

Why Do Americans Feel Financial Pressure?

Despite having some of the highest incomes in the world, most Americans experience constant financial pressure due to weak savings habits and limited access to liquidity.

At Factum, we’ve identified two key reasons why:

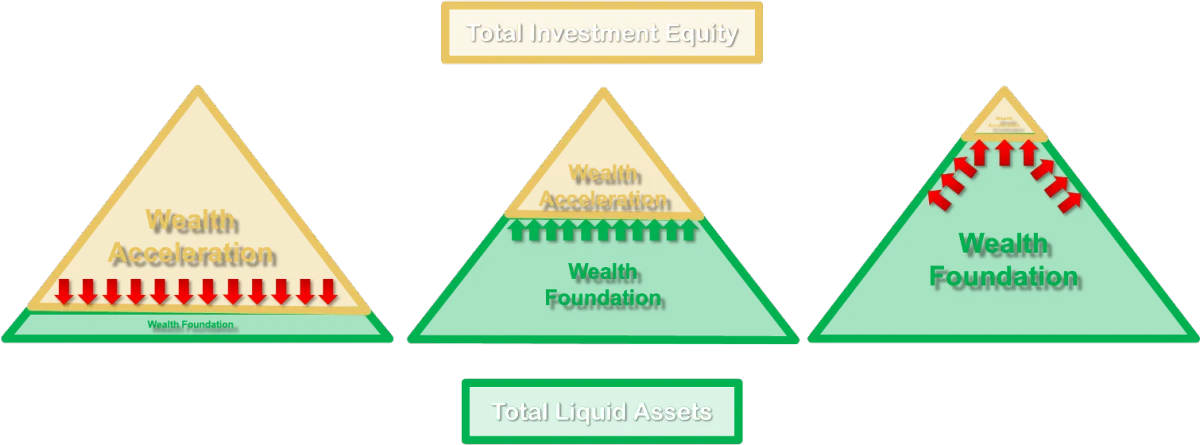

At Factum, we empower individuals and families to alleviate financial pressure by building TOUGH MONEY Habits—habits that create control, certainty, and long-term financial success.

To build TOUGH MONEY, you need to answer the FIVE most important financial questions:

Q1: Do you know how much you should be EARNING in passive income to live the life you have always wanted?

Q2: Do you know how much you should be SAVING to achieve your passive income goal?

Q3: Do you know how much you should be HOLDING in cash reserves to guarantee your protection and opportunities when events happen?

Q4: Do you know if the current environment where you hold your money is MAXIMIZING THE BENEFITS you deserve?

Q5: How would you rate your current MONEY MANAGEMENT HABITS?

If you don’t have clear answers to these questions, you’re not alone.

That is why Factum exists—to help you develop TOUGH MONEY Habits that lead to having the TOUGH MONEY EFFECT in your life.

Why Choose FACTUM?

By partnering with you, we believe we can build stronger, lifelong relationships that support your ongoing success. Together, we will lead the way toward a more secure financial future.

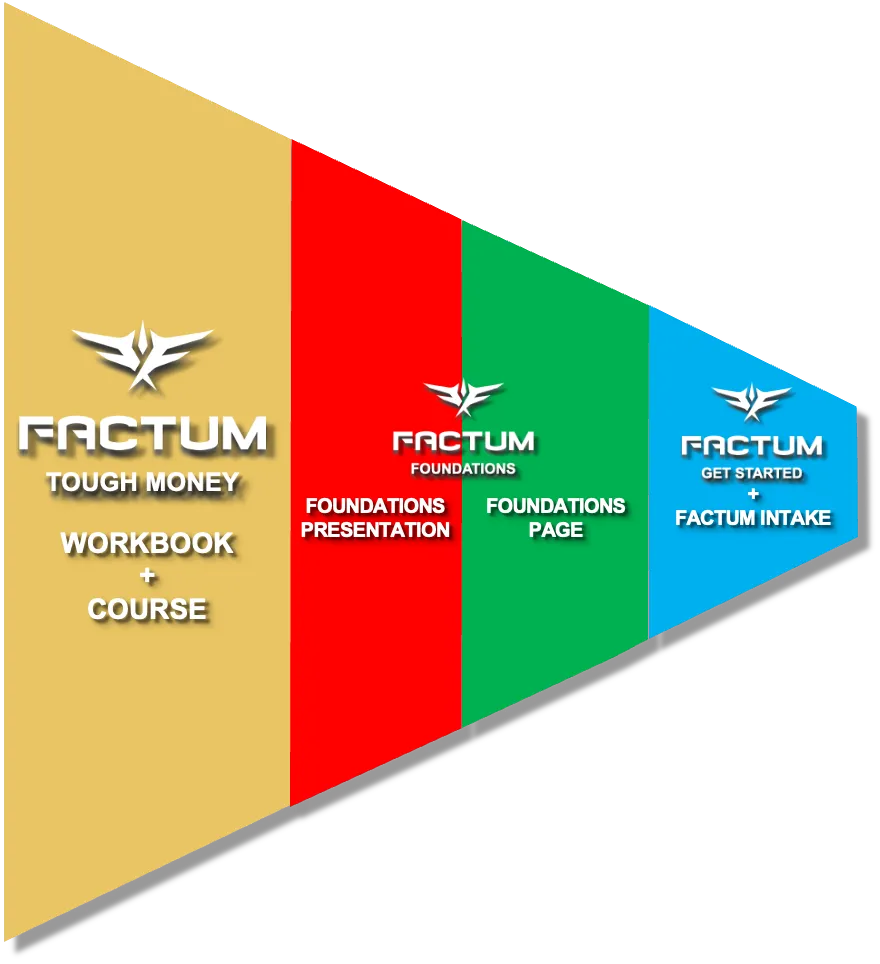

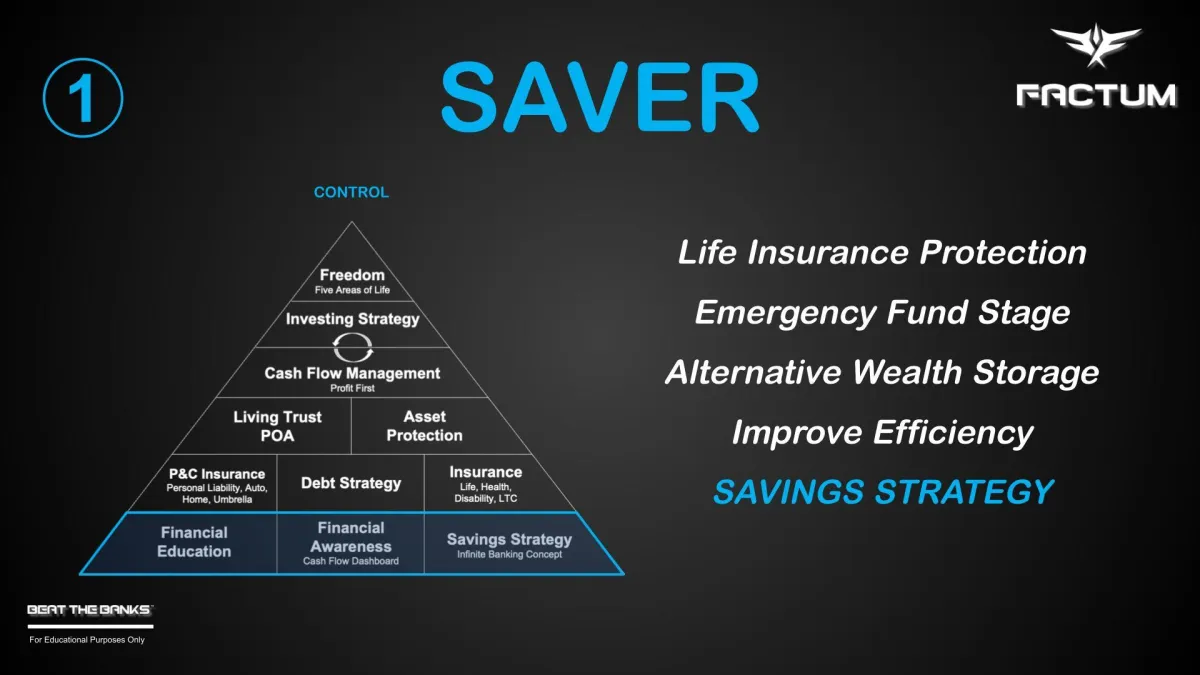

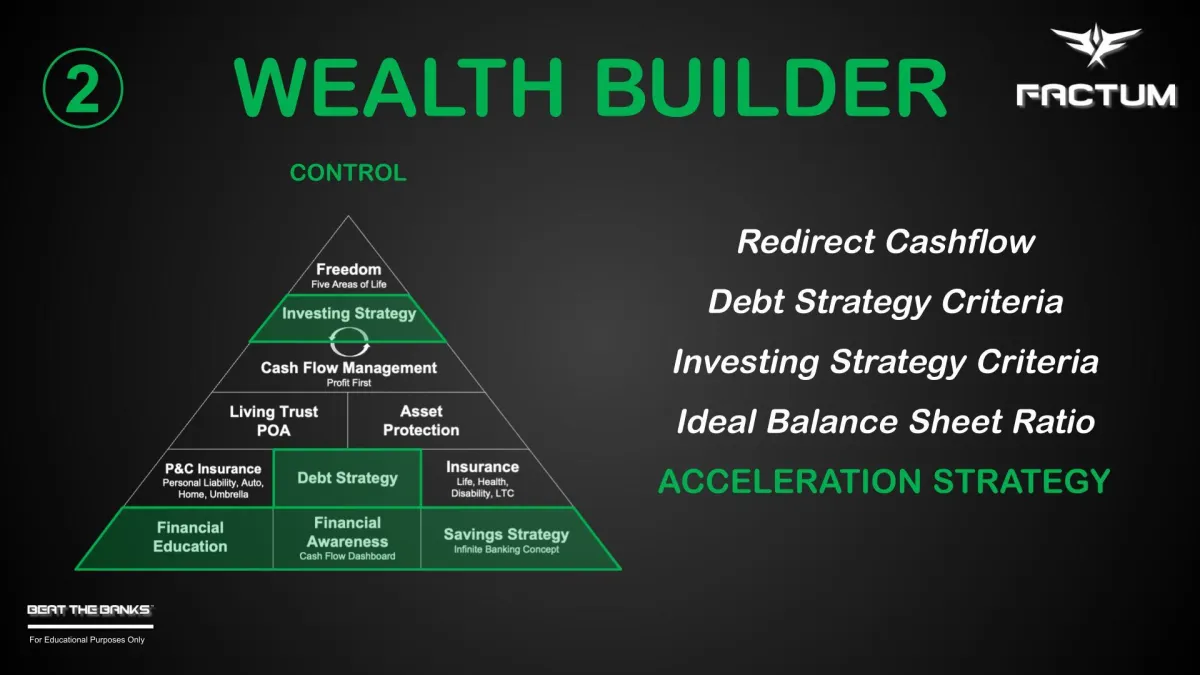

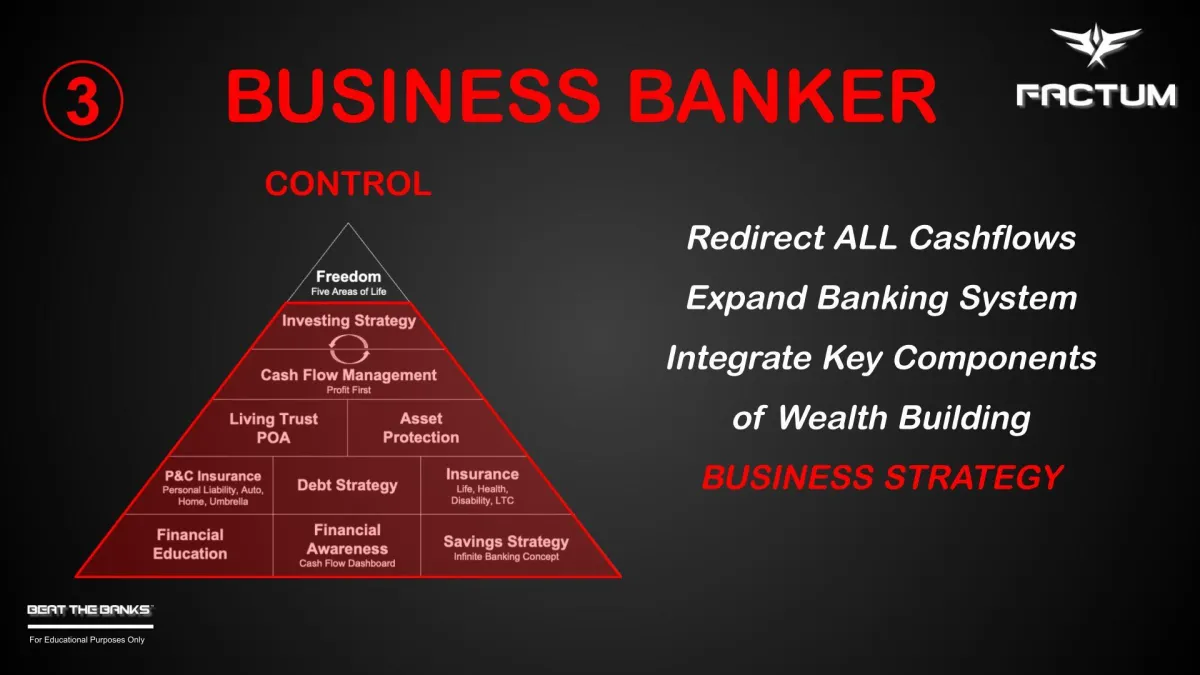

Financial Education

What sets us apart is our unrelenting focus on education. We provide you with deep insights into the flaws in the current financial system, without you ever feeling like you've been "sold".

Financial Awareness

Education based on truth leads to financial awareness. When you understand your finances, you’ll know exactly what to do.

Effective Implementation

We teach you how to apply financial principles using our exclusive systems, processes and tools to help you develop tough money habits and build wealth with certainty.

Action-Oriented Community

Our unique approach to wealth building empowers you to achieve results quickly and effectively, supported by a community dedicated to building tough money.

Track Record of Success

Served

2,120

Families

Created

$756 Million

in Protection & Legacy

Maintained

99%

Client Renewal Rate

Our Preferred Insurance Carrier

We are proud to endorse OneAmerica Financial as our primary insurance carrier for Whole Life and Infinite Banking. This endorsement is grounded in OneAmerica’s exceptional attributes and alignment with our core values.

Why OneAmerica Financial?

A Legacy of Excellence

OneAmerica Financial is a mutually owned, multi-billion-dollar company with over 100 years of operational history. Their long-standing commitment to stability and performance is exemplified by their consistent payment of dividends for over a century. Their top-rated status among financial institutions underscores their reliability and strength.

Aligned Core Values and Innovative Solutions

OneAmerica Financial's core values resonate deeply with our own, emphasizing integrity, customer focus, and long-term success. Their leadership’s personal belief and ownership in Whole Life Insurance reflects a profound belief in the products they offer.

Their Whole Life policies feature some of the strongest guarantees, ensuring a secure foundation for you. Additionally, the flexibility of Paid-Up Additions (PUA) premiums allows for tailored financial strategies, while their monthly cash value reporting provides transparent and timely insights into your policy’s performance.

By choosing OneAmerica Financial, you are aligning with a partner that combines a rich heritage of excellence with forward-thinking solutions.

How We Chose a Carrier

Stages of Whole Life Insurance

What Others Have to Say...

2026 Factum Financial. All Rights Reserved.